stETH depeg crisis - A huge threat for the crypto market

Recently, stETH is reported to depeg continuously and this phenomena is foreseen to cause enormous panic, starting with ETH crash - the second-largest cryptocurrency.

Let's analyze with 1Shield to understand how stETH depeg crisis can affect the overall crypto market.

What are stETH and Lido?

Lido is a liquid staking solution for ETH backed by industry-leading staking providers. Lido lets users stake their ETH - without locking assets or maintaining infrastructure - whilst participating in on-chain activities, e.g. lending.

stETH is a token that represents staked Ether in Lido, combining the value of initial deposit + staking rewards - penalties. stETH token balances are pegged 1:1 to the ETH that is staked using Lido.

What happened to stETH and its impact on ETH?

Recently, stETH token, which is supposed to trade at a 1:1 peg to ETH, is currently trading at a discount to ETH. On 12th June, stETH was trading at $1409.57, down 5.4% in the last 24 hours while Ethereum was still trading at $1469. Noticeably, stETH has been depegging since late Thursday and one of the reasons behind this fall is assumed to be the large-scale selling of the token by its owners. To be specific, one of the largest holders of stETH, Alameda Capital has dumped $1.5 Billion of stETH since they saw the possibility of ETH crash.

stETH is usually used as a collateral to borrow more ETH on DeFI platforms. Nevertheless, if its prices fall sharply, holders will be forced to sell stETH on the open market because positions which have borrowed ETH using stETH are susceptible to being liquidated. As a consequence, stETH price drop can be even deeper.

Although it is said that stETH has no direct link with ETH, losses in stETH might have triggered panic selling of Ethereum, leading to, may be, a fall in prices of Ethereum and other cryptos.

Panic in the crypto market

So let's analyze the case deeper to understand why this “depeg” can potentially spread a large-scale negative impact in the crypto market.

As mentioned above, the selling stETH of Alameda Capital contributes to make the token depeg deeper. Like a Domino effect, other investors also feel the threat and afraid of the possibility of ETH crash; they swap stETH to ETH despite the loss to secure their assets.

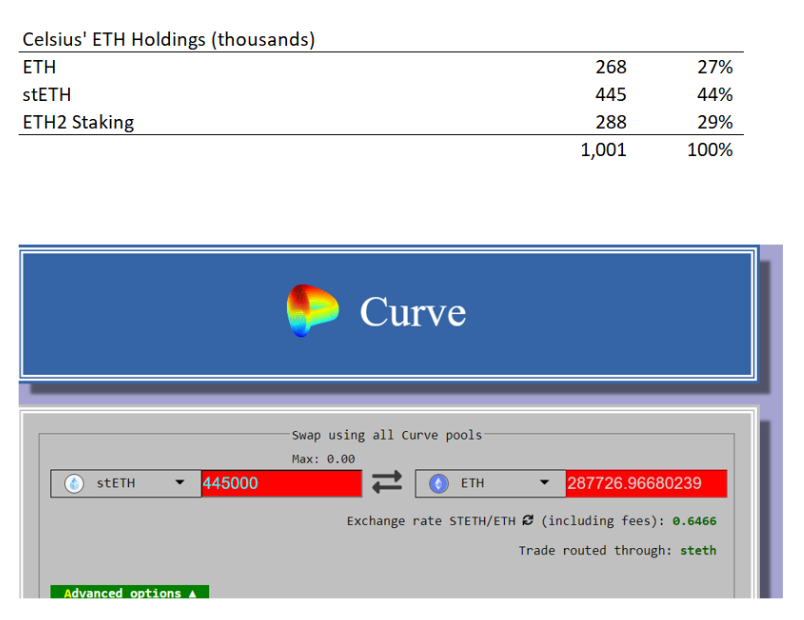

Celsius is a DeFI bank that currently holds 450.000 stETH, equivalent to $1.5B USD. As a consequence of the Domino effect, Celsius is facing continuous withdrawal requests from users, but in fact Celsius is currently lacking liquidity to respond to these demands.

The reason behind this lack of liquidity is the fund Celsius holding has only 27% (in ETH) that can be liquidated immediately. The remaining 73% including stETH and ETH2 Staking can not be withdrawn now and have to wait to unlock.

So, in order to fulfill the withdrawal, Celsius chose to use current stETH to borrow other crypto tokens in AAVE, Compound, ect.

The case will not stop and there is high risk that stETH will continue to depeg, causing Domino effect and consequently pulling ETH price down. The real panic in the crypto market has just begun.

Takeaway lesson for investors

From this crisis, users must understand that all types of cryptocurrency carry various potential risks. Although that crypto coin is on the top with large pool liquidity or having big DeFi projects's participation, its peg mechanism and asset-based lending can always lead to unwanted consequences for users. 1Shield suggests all investors should Do your own research carefully and consider all aspects before making your investment decisions. Be a smart investor!

———————————————————————————————

About 1Shield

1Shield provides Audit & KYC services to help build trust in the Blockchain industry. With expertise in formal verification and fast audit process, 1Shield ensures your project will get invaluable credibility.

Website | Twitter | Blog | Telegram Channel